How Argentina’s Blue Dollar Works

What is the blue dollar, exactly?

Short answer: The blue dollar is a way to slash the costs of your visit to Argentina by 50%.

Long answer: If you get your cash exchanged for Argentinian pesos somewhere that’s offering blue dollar rates, or send yourself money through Western Union, you’ll get double the official exchange rate. For the avoidance of doubt, exchanging cash at banks, withdrawing cash at ATMs and paying by card in Argentina will have you paying official rates.

Blue dollar rates change daily, like any other exchange rates, so you can find what it is at present through Cuex.

There’s a long story behind why the blue dollar exists and a whole art to getting blue dollar cash, both through cambios and Western Union. This post will take you through both and teach you how to avoid the many, many pitfalls you could otherwise run into.

Why does the blue dollar exist?

Economics lesson time: high inflation rates and low confidence in a country’s economy cause its currency to depreciate in value against others, and Argentina has been plagued by both for a long time.

Argentina’s economy has a long history of ups and downs, and as I write this post, inflation is at 88%. Some experts are forecasting that it could reach 100% by the end of the year. On the ground, price changes in Argentina are nowhere near as bad as in Venezuela or prewar Germany – generally, shops in Argentina will at least wait until closing time before increasing their prices. Still, they do change frequently, sometimes by the day.

Take notes, dear traveller: that photo of the menu on Google Maps from a month ago has almost certainly gone up by now.

As a result, Argentinians typically do two things when they get paid: they spend some of their salary on food, and anything else they need immediately, then convert the rest to a more stable currency. The US Dollar is a favourite, although Euros are also quite popular. Returning to our economics lesson for a moment, the near-constant depreciation of the Argentinian peso often matches the rate of inflation. In other words, an Argentinian who converts their pesos to US Dollars today then back into pesos in, say, a month’s time, will have more pesos than when they started, and they’ll still be able to afford whatever they were saving for despite its now-higher cost.

With me so far? Grand.

Now, here’s the thing: because converting pesos into foreign currencies is effectively “selling” them, and practically everybody in Argentina is doing it, that leads to the peso being devalued further. It’s supply and demand in action. This makes foreign imports more expensive and leads to inflation worsening.

Rinse and repeat.

To try to prevent this, the Argentinian government implemented restrictions on how much Argentinians could exchange. US$200 is the maximum people can buy each month, roughly a fifth of the average salary, at a rate set by the Central Bank.

After this $200 limit has been reached, the only option for those who want to buy more foreign currency is to go to a cambio, at a rate governed exclusively by the laws of supply and demand. Foreign currency is much more expensive through this method, since many Argentinians want it and there isn’t much coming in – save for the odd foreign tourist who “imports” a small amount. However, it’s still worth it to many people since this currency enables them to circumvent inflation.

And the price people will pay at the cambio is known as the blue dollar.

How to get blue dollar rates with cash and cambios

The first step is to get yourself some cash, so head to the nearest ATM. Got some? Fandabbydosey. Unfortunately, you might have already run into pitfalls: cambios will only accept bills that are in mint condition (no creases, tears or marks) and can be particular about which currency they accept.

US dollars are always accepted, while Chilean pesos, Brazilian reals, euros and British pounds are also widely accepted. However, don’t be surprised if the cambio you visit doesn’t. If you want to be on the safe side, get whatever cash you have converted to US dollars first.

Store this cash in a money belt, your passport, a book or anywhere else where it’s unlikely to get damaged.

Cambios’ rates are always better than the official rate, but some will offer better rates than others, so shop around. You’ll also get a better rate if you’re carrying large bills.

Rates are generally negotiable, so it makes a lot of sense to haggle a little. If this is your first time doing it, ask if they can do a better rate, or write down a specific amount. While this will result in them increasing their initial offer, if the “best they can do” still isn’t good enough, tell them you might come back. There’s no shame in doing so and then agreeing to their offer if it really is the best in town. Also, the possibility that you may find a better offer might just be enough to tip them over the edge. However, if they agree to your offered rate, it’s considered very poor etiquette to then say “alright, thanks, I’m still going to shop around though”.

And through it all, remember to smile!

How to get blue dollar rates with Western Union

Western Union is many peoples’ preferred method of getting blue dollar cash since it often offers slightly better exchange rates than the “official” blue dollar rate and removes the need to carry around or have large amounts of foreign currency.

For anyone who’s not used it before, first type into the search bar westernunion.com/, followed by your country’s alpha-2 code: us if you’re from the States, gb if you’re British, de if you’re German, and so on, so forth.

You’ll see the following screen or some variation of it:

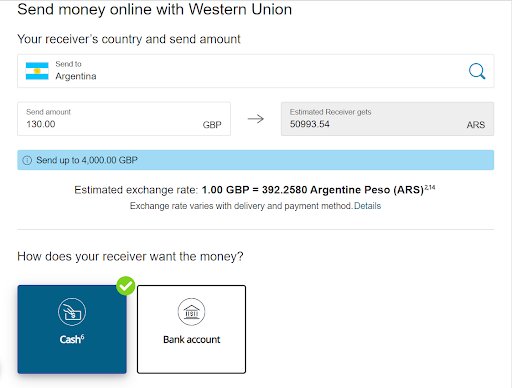

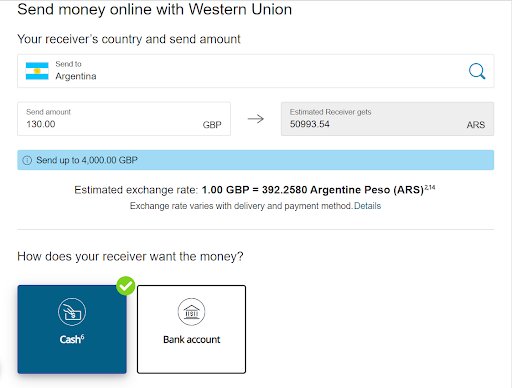

Select Argentina as the country, and the amount you want to send.

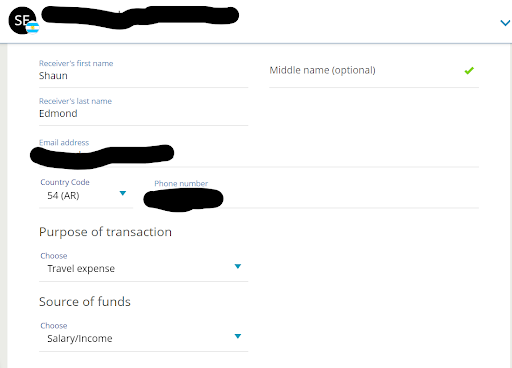

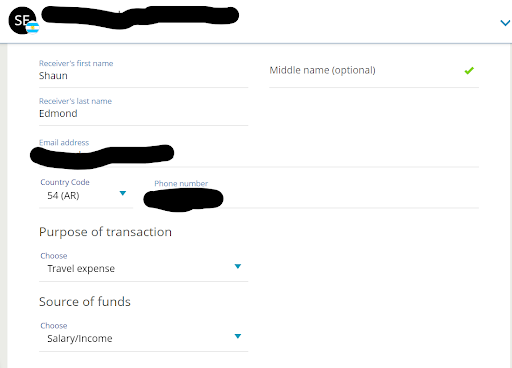

Next, you’ll see an interface with how many pesos you’ll get, how the receiver (that’s you) would like to receive the money (choose “cash”) and how you’d like to pay. On the side, you’ll also see how much Western Union will charge you for the transfer, though this will never be anything extortionate. First-time users may even get theirs for free.

You’ll then be taken to a page where you’ll enter the receiver’s information. Don’t worry too much about what you enter for the “Source of funds” field, and you can use your phone number from home without any problems. Just be sure to enter your email correctly, since this is where they’ll send your purchase confirmation – and within this will be your tracking number, which you’ll need to present when you pick up your cash.

Once you’ve paid, you’ll receive an email confirmation. This may take some time if Western Union needs to do something with your bank, but it should come through within half an hour. You can cancel your transfer at any point before you pick up your cash.

That done, use the site’s branch locator to find a Western Union outlet in your destination and head to it to pick up your cash. Be sure to bring your passport, your email confirmation on your phone and a money belt. And a lot of patience.

Now, this is where things can get frustrating…

First of all, Western Unions in Argentina almost invariably have long lines that move at a glacial pace. My experience in Buenos Aires took about half an hour, while some people I met in Ushuaia said that theirs had taken two.

Second, you might find that the wait was in vain. Save for the large outlets in Buenos Aires, many Western Unions run out of pesos to give every day. It may well happen that the person in front of you gets their cash, while you don’t. For that reason, it’s a good idea to turn up early and not request too large an amount each time: usually 40,000 pesos should be doable, but 100,000 in El Calafate is a bit more of a tall order.

Additionally, Western Unions will sometimes say that “the system is down” or “the system is closed now” even though the time is still in their operating hours.

For all these reasons, I’d recommend taking some cash with you to Argentina as a plan B, or if you’re short on time.

Is all this blue-dollar business legal?

To call this a legal grey area wouldn’t even begin to cut it. This is a circumvention of currency controls, and if you were to ask a government minister they would probably say yes, it is illegal.

That’s about as far as it goes, since the way blue dollar business is done is nothing short of blase. Major newspapers publish its rate every day, people in the high streets of Buenos Aires yell “cambio, cambio, cambio” into the air while police don’t bat an eye, and grocery shops offer exchange services with signs displayed that would be very difficult to hide should the law come knocking. On top of all this, the fact that Western Union, a major money transfer service, offers blue dollar rates online and does business mere steps from the presidential palace, really throws the illegality of it all into question.

Anyway, to allay anybody’s fears: there’s no chance of getting arrested or fined for getting pesos at blue dollar rates, especially not if you’re using Western Union.

And here’s a little parting thought: since you’ll end up paying 100% more at official rates, you’re guaranteed to be punished for not playing the blue dollar game.